north carolina estate tax certification

AOC-E 212 OR an Inheritance and Estate Tax Certificate issued by the North Carolina Department of Revenue will need to be completed by the time you file the final account. STATE OF NORTH CAROLINA File No.

Neil Brown National Instructor Cpa Ce Aicpa Linkedin

County Assessor and Appraiser Certifications.

. 54 counties are currently reporting closings andor advisories View active closings. It is first advisable that any business read the North Carolina Solid Waste Management Rules regarding the standards for special tax treatment before applying. Instant access to fillable Microsoft Word or PDF forms.

This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws and statutes. Duty to Furnish a Certificate-On the request of any of the persons prescribed in subdivision a 2 below the tax collector shall furnish a written certificate stating the amount of taxes and special assessments for the. Estate Tax Certification For Decedents Dying On Or After 1 1 99 E-212 Start Your Free Trial 1399.

In the General Court Of Justice. Requirements for Certification by the North Carolina Tax Collectors Association Revised May 9 2012 A. Tax Certification Program North Carolina offers a tax exemption on equipment and facilities used exclusively for recycling and resource recovery.

Before The Clerk County. Under North Carolina General Statute 105-289 The Department of Revenue is charged with the duty to exercise general and specific supervision over the valuation and taxation of property by taxing units throughout the State. An Estate Tax Certification Form No.

Deeds must have grantee address affixed on first page for tax billing purposes. What Is the Estate Tax. Once certified by the Veterans Benefit Administration the form will be returned to your primary residence.

State of north carolina county sales and use tax report summary totals and certification page_____of _____ contractor project. Find COVID-19 orders updates and FAQs. Inheritance And Estate Tax Certification North CarolinaStatewideEstate Letters North CarolinaStatewideEstate.

The state exemption amount was tied to the federal one which means that for deaths in 2012 estates with a total. If you believe the data in this table is incorrect please notify Dave Duty in the. You will then submit the NCDVA-9 to your local county tax office.

The following table may be used to verify data in our records for those individuals. Estate Tax Certification For Decedents Dying On Or After 1199 By North Carolina Judicial Branch. Tax Collectors must meet the requirements as set forth in GS 105-349 of the Machinery Act.

North Carolina is not one of those states. This is an official form from the North Carolina Administration of the Courts AOC which complies with all applicable laws and statutes. For assistance or to acquire a copy of the tax certification form contact the Alleghany County Tax Office at 336-372-8291.

FOR DECEDENTS DYING PRIOR TO JANUARY 1 1999 Name Of DecedentDate of Death See Side Two GS. The deadline to submit your documents to your county tax office is June 1st of the current tax year. Inheritance and Estate Tax Certification North Carolina Judicial Branch.

Inheritance And Estate Tax Certification - Decendents Prior to 1-1-99. The estate tax sometimes referred to as the death tax is a tax levied against the estate of a recently deceased person before the money passes to the designated heirs. This certification must be affixed to the Deed prior to recording.

Previous to 2013 if a North Carolina resident died with a large estate it might have owed both federal estate tax and a separate North Carolina estate tax. Remember therere abilityed in the ability of intimidation. Estate Tax Certification For Decedents Dying On Or After 1 1 99 North CarolinaStatewideEstate Inheritance And Estate Tax Certification North CarolinaStatewideEstate Letters North CarolinaStatewideEstate Letters Of Appointment Guardian Of The Estate.

USLF amends and updates the forms. A fee will be due when the account is filed. The Property Tax Division of the North Carolina Department of Revenue is the division responsible for this administration.

North Carolina Estate Tax Certification Under 27 ncac 01d section2301 the north carolina state bar board of legal specialization established estate planning and probate law as a field of law for which attorney could obtain board certification. Estate tax certification north carolina the taxes by way of you and theyll do anything to prisonly finish the identical job including seizing your on-line business and individualal assets. Deeds must have Tax Certification obtained from the Alleghany County Tax Administrator.

The tax rate is 200 per 1000 of the purchase price of the real estate. Aall official court forms are reproduced by permission of the north carolina administrative office. Effective January 1 2013 the North Carolina legislature repealed the states estate tax.

USLF amends and updates the forms. The certification program shall be available to Tax Collectors Deputy Tax Collectors and Assistants support staff. 251 North Main Street Room 190 Winston-Salem NC 27155.

Estate Tax Certification For Decedents Dying On Or After 1199. North Carolina law requires the Department of Revenue to provide a certification and continuing education program for county assessors and appraisers. IN THE MATTER OF THE ESTATE OF.

The estate tax is different from the inheritance tax. Licensed and in good standing to practice law in North Carolina as of the date of application. Please review the general requirements for certification and continued certification as well as the standards for Estate Planning and Probate Law.

There is a federal estate tax and some states also levy a local estate tax. The grantor must pay the Real Estate Excise Tax at the time of recording.

Department Of The Army Headquarters Xviii Airborne Corps And Fort Bragg Fort Bragg North Carolina Fort Bragg Fort Bragg North Carolina Airborne

Authentications Of Documents State North Carolina

Why Certificates Of Service Are Important Rice Law

Authentications Of Documents State North Carolina

North Carolina Certificate Of Title Bond Ameripro Surety Bonds

Table 2 Federal And State Individual Income Tax Bill For Taking The Cash Option On The 2018 Hgtv Smart Home In Bluffton South Ca Income Tax Diy Network Income

Item Of Interest Stock Share Certificates Retro Vector Stocks And Shares Two Stock

Ohio Quit Claim Deed Form Quites Ohio Marital Status

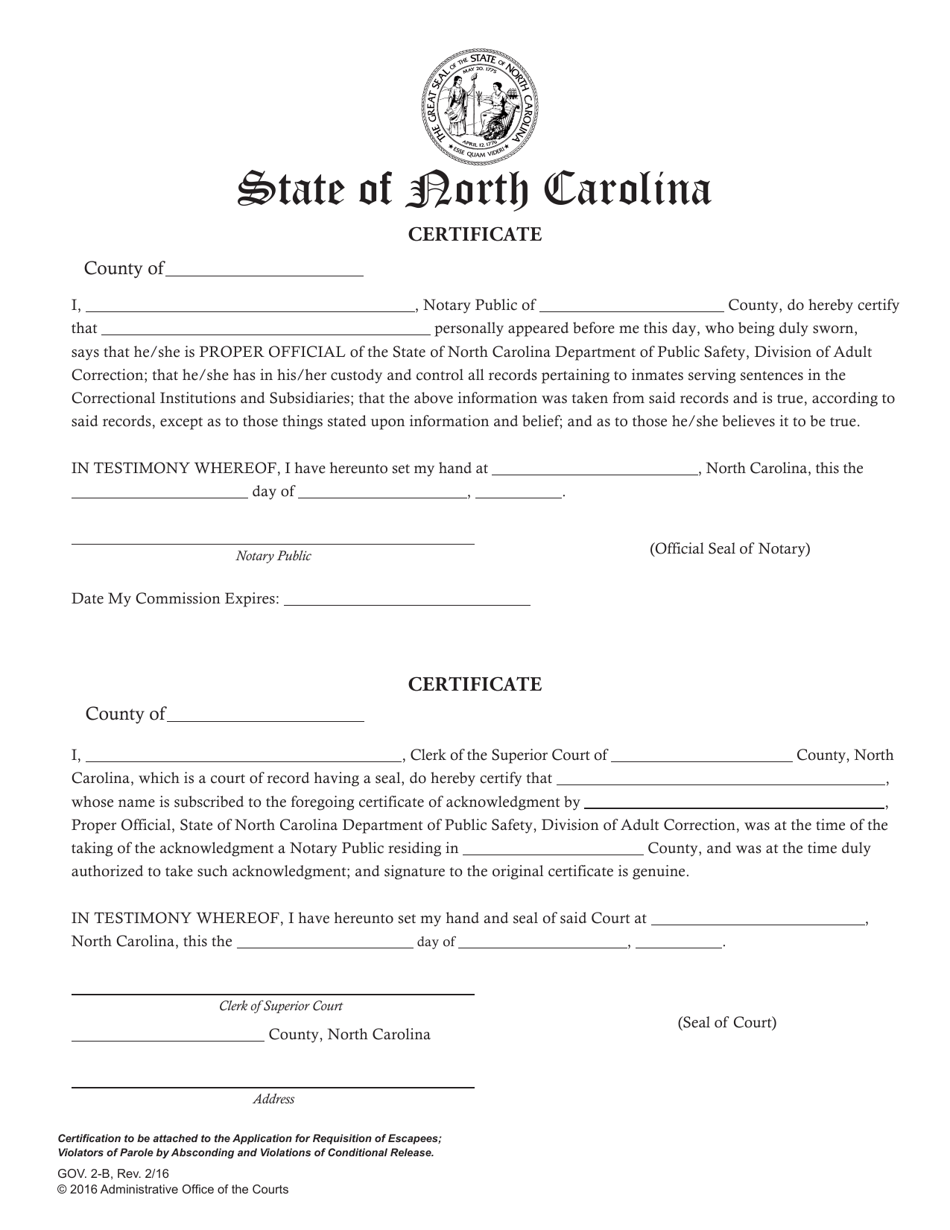

Form Gov 2 B Download Fillable Pdf Or Fill Online Certificate Of Notary North Carolina Templateroller

Solomon Islands Bsp Bank Statement Template In Word And Pdf Format Gotempl Templates With Design Service In 2022 Statement Template Bank Statement Words

S Mcdonald S Corp Ipo Stock Certificate 1965 100 Shs Specimen Stock Certificate Of Ipo Stock R Stock Certificates Dow Jones Index Social Security Card

Back To Genealogy Basics Marriage Records Are You My Cousin Marriage Records Genealogy Family Tree Genealogy

North Carolina Secretary Of State Land Records Certified Mapper Qualifications

Rutherford Gold Company Stock Certificate In 2022 Stock Certificates Certificate North Carolina Capital

Nc E 590 1992 2022 Fill Out Tax Template Online Us Legal Forms